Ira withdrawal tax calculator 2021

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. How is my RMD calculated.

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

When considering making an early withdrawal from your retirement savings it is important to understand the potential impact of such a decision.

. May not be combined with other offers. Ira withdrawal calculator 2021 Minggu 04 September 2022 Edit. Uniform Lifetime Table for all unmarried IRA owners calculating their own withdrawals married.

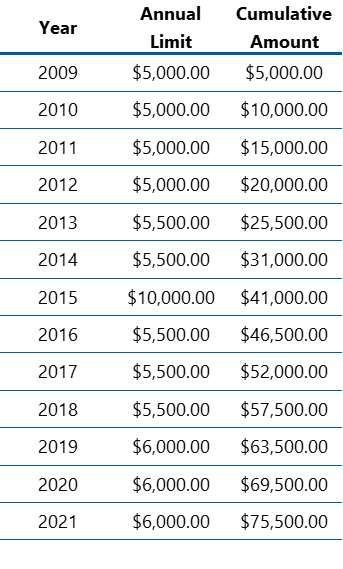

Roth IRA Contribution Limits for 2021 and 2022. 35 percent for income between 200000 and 500000. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. Youll owe taxes at your ordinary income tax rate remember it just applies to earnings and a 10 penalty. Calculate your earnings and more.

Im looking for a way to calculate my basis for contributions in my roth ira. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. You can take distributions from your IRA including your SEP-IRA or SIMPLE-IRA at any time.

Starting the year you turn age 70-12. Your life expectancy factor is taken from the IRS. And 37 percent for income over 500000.

And is based on the tax brackets of 2021. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. However if you withdraw.

9 If you earn too much to. Use this worksheet for 2021. 0 6 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. Tables to calculate the RMD during the participant or IRA owners life. Posted on November 29 2021 by.

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. I made an early distribution in 2021. However your distribution will be.

For those married filing jointly the 2021 MAGI limit is 208000 214000 for 2022 with a phase-out starting at 198000 204000 for 2022. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually. State income tax rate.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawal s from IRAs for up to. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction.

When you withdraw the money both the initial investment and the gains it earned are taxed at your income tax rate in the year you withdraw it. Required Minimum Distribution Calculator. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for.

If you dont have that. Traditional IRA Calculator Details To get the most benefit from this calculator you should use data that reflects your current financial situation. Withdrawing money from a qualified retirement account such as a 457 plan.

There is no need to show a hardship to take a distribution. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Ira withdrawal tax calculator 2021.

I - Answered by a verified Tax Professional. While long-term savings in a Roth IRA may. 2021 Estate Income Tax Calculator Rates The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum.

For a Traditional IRA you can contribute up to 6000 for the tax year 2021 and 6000 for the. If youre single and your taxable income is 100000 per year for example your. Account balance as of December 31 2021.

It is mainly intended for residents of the US. 2021 Early Retirement Account Withdrawal Tax Penalty Calculator Important. Calculate Your Tax Year 2022 Required Minimum Retirement Distribution.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Paying taxes on early distributions from your IRA could be costly to your retirement.

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

The 3 Most Surprising Social Security Benefits You Can Get The Motley Fool The Motley Fool Investing Dividend

After Tax Contributions 2021 Blakely Walters

2021 Estate Income Tax Calculator Rates

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Tax Calculator Estimate Your Income Tax For 2022 Free

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Is A Traditional Ira Edward Jones

Tfsa Limit For 2021 Announced Fbc

/IRA_Version1_4194258-650d1a6879eb40809b6872af8daa907c.png)

Individual Retirement Account Ira What It Is 4 Types

Retirement Spending Which Accounts Come First Physician On Fire First They Came Retirement Finances Retirement

Canadian Foreign Tax Credit On Ira Distribution

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill